Dive Brief:

- The U.S. will need to triple its retrofit rate to meet net-zero targets, with 80% of today’s office buildings to still be in-use by 2050, according to a JLL report sent to Facilities Dive.

- The Retrofitting Buildings to be Future-Fit report, released last November, found that existing stock will have to be retrofitted at 3% to 3.5% per year if net-zero targets are to be met.

- The report points to a significant knowledge gap and emphasizes the need to upskill the labor force and encourage sustainability training for building technicians.

Dive Insight:

The current rate of retrofits in the global North is about 1%, or less than a third of the required 3% to 3.5% target rate, which will not provide enough decarbonization to align with the Paris Climate Agreement. The report conservatively estimates a need for more than $3 trillion to retrofit office stock across the 17 major countries in that territory.

Even in high-growth emerging cities, where new construction could more than double existing stock by 2050, tripling the current retrofit rate will be a “formidable undertaking,” the report noted. In addition to the estimated cost for 2050 net-zero target retrofits, it also found a large knowledge gap when it comes to conducting deep retrofits.

JLL attributes this knowledge gap to a shortage of technical expertise, pointing to an urgent need to upskill the labor force; encourage sustainability training for building engineers, architects and consultants; and apprise stakeholders of the benefits of retrofitting existing buildings.

These changes will need to be made rapidly now, and consistently for the next 30 years, to meet climate pledge goals and decarbonization mandates. But the knowledge gap and labor shortage pressures across U.S. facilities present key roadblocks, and occupiers are already feeling the pinch. As a result, some have started upskilling workers, aiming to bridge the chasm of scarce labor supply. Biotech trade society MassBio, for instance, launched its own nonprofit aimed at training and upskilling workers in May, to reduce the facilities labor crisis affecting the life sciences industry.

The healthcare platform lists future-proofing assets, ROI, rental uplift, tenant retention and attraction, and reducing financial risk as critical factors to accelerating the race to retrofit buildings.

The tenant retention, attraction and rental uplift are important aspects of those suggestions, evidenced by 74% of organizations included in JLL’s 2022 Future of Work Survey responding they would pay a premium to lease a building with leading sustainability and green credentials. Twenty-two percent of respondents said they already have paid a premium for offices with these credentials, suggesting that buildings that do not undertake deep retrofits will see reduced demand and lower lease agreements.

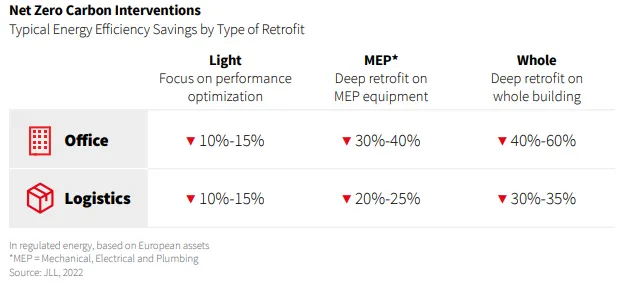

The report also provides estimated energy efficiency savings by type of retrofit, and outlines how facilities management professionals can ensure that their buildings meet net-zero carbon emission standards and decarbonization goals.

The report estimated 40% to 60% energy efficiency savings for deep retrofits of whole office buildings, compared to 10% to 15% for light retrofits.

While electrifying building systems requires a large capital investment, JLL says it is more effective than implementing incremental, small energy conservation retrofits, such as replacing a fossil fuel burning boiler with a more efficient gas burning system. While cheaper in the short-term, these retrofits do not fully remove emissions from a building’s operations.

On the other hand, system electrification helps to future-proof assets, enables better ROI determinations for investors, and can be used to bundle initiatives into larger capex projects and reduce payback periods for the upgrades.