Dive Brief:

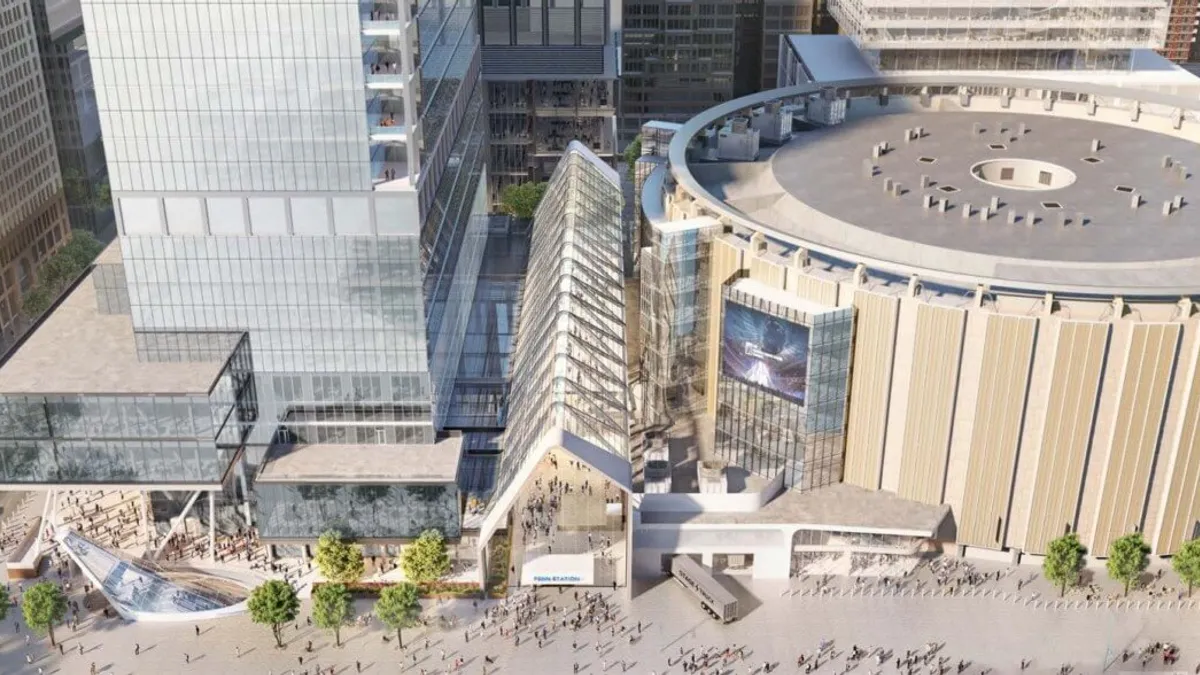

- Vornado Realty Trust, a New York City-based real estate investment trust, has hit pause on an 18 million-square-foot project in midtown Manhattan, according to the company’s latest earnings call. The plan, which called for the construction of 10 new skyscrapers housing mostly office space and about 1,800 apartments, formed part of the $22 billion Penn Station redevelopment.

- Muted demand for office space, high interest rates and unfavorable capital markets have pushed Vornado to delay the Penn Station project for another two to three years, and to rethink its new construction work, said Michael Franco, Vornado president and CFO, during the company’s earnings call last week.

- The proposed skyscrapers formed part of New York Gov. Kathy Hochul’s plan to redevelop Penn Station by using the tax revenue generated by the Vornado project to fund the reconstruction of the transit hub.

Dive Insight:

A full year of higher interest rates will cause 2023 to be a slower year for construction activity, said Vornado CEO Steven Roth during the call.

“Steel, concrete and curtain walls are important, but in our business, capital is the essential raw material,” said Roth, who said high interest rates are making funding for projects scarce.

Meanwhile, construction financing, if available, remains “very expensive,” said Franco. Roth said the capital markets are “making it almost impossible to build new.”

Yet the Federal Reserve will likely maintain higher borrowing costs for the considerable future, said Anirban Basu, chief economist at Associated Builders and Contractors, recently in a press release. That could further cause dips in backlog and contractor confidence levels.

Last fall, Roth brought up the difficulty of developing new projects in a shaky economy, leading Hochul to say that the Penn Station redevelopment project will move forward with or without Vornado and that the city has “other sources of financing for Penn Station,” according to NY1.

Other developers have also attributed the economic climate to pushing project prices even higher.

For example, the cost of the Mutual of Omaha headquarters tower in downtown Omaha, Nebraska, has jumped from $443 million to $600 million. Similarly, the developers of the MSG Sphere entertainment project in Las Vegas raised its price tag about $180 million in November due to the ongoing impact of inflation and global supply chain pressures.

Sarah Martin, Dodge Construction Network senior economist, said to expect weakness in traditional office projects this year, especially as remote and hybrid work continue to be prevalent.

Roth said he sees office occupancy beginning to pick up in Vornado’s portfolio, but does not expect a full five-day in-office work week to ever return again.

“We’re getting close to 60% [office occupancy] on Tuesdays, Wednesdays and Thursdays,” said Roth during the earnings call. “I think you can assume Friday is dead forever. Monday is touch and go.”