Electric vehicle (EV) charging may seem like a budding trend to consumers, but it’s anything but new to c-store operators.

About 95% of U.S. fuel retailers surveyed said they’re currently offering or planning to offer EV charging stations, while 70% said they’re planning to expand their fuel network in the coming years, according to a 2022 study from Boston Consulting Group.

As the fuel landscape continues to evolve amid changing consumer habits and digital technologies, larger c-store chains are jumping at EV charging. Wawa began hosting EV charging at its stores in 2017, while 7-Eleven revealed plans in 2021 to develop at least 500 charging stations at 250 stores in the U.S. and Canada by the end of 2022. And during this summer, Circle K and Couche-Tard set a goal to have 200 charging sites by 2024, while Phillips 66 made its own plans to bring EV drivers to its stores.

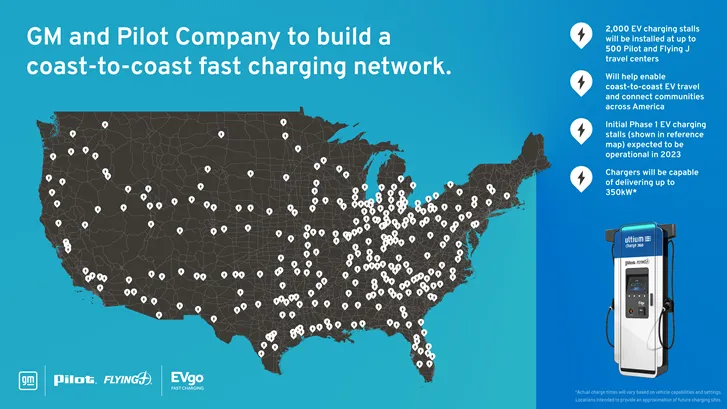

But in one of the most ambitious EV initiatives the c-store industry has seen to date, the Pilot Company announced in July that it’s building a network of 2,000 fast charging stations across 500 of its U.S. travel centers and expects the first chargers to be ready for use in early 2023. Pilot is collaborating with auto manufacturer General Motors and EV fast charging network EVgo on the project.

In the project’s earliest phase, Pilot wanted to get ahead because it knew EVs were coming fast — and there was plenty to learn.

“‘There’s so much we don’t know, there’s still a lot to be learned’ — that was our thinking at the time,” said John Tully, VP of strategy and business development for Pilot. “The EV driver community is growing, and those are current and future customers of ours. We wanted to be part of that solution.”

At a time when many c-store chains are building hundreds of EV charging stations on site, Pilot’s initiative to have thousands signals an EV arms race taking shape in the c-store space.

The right partnership

Before partnering with Pilot, GM had already committed to investing $750 million towards building EV charging infrastructure and enabling access to more than 2,700 fast charging points in the U.S. through 2025 as part of its Ultimate Charge 360 initiative.

“Making EVs viable as a primary vehicle is what we’re targeting,” said Aaron Wolff, business development and strategy manager, EV charging infrastructure, for GM. “One of the big pain points always cited is ‘What if I need to go on a road trip? Are there chargers that will be there for me in the right spot?’”

This pain point Wolff describes is known as range anxiety. To help curb it, he knew GM needed to place chargers roughly every 50 miles along major U.S. highways. That drew him to Pilot, which operates Pilot Flying J, the largest truck stop and travel center chain in the U.S.

Once Pilot came aboard, the next step was to find the right charging network to help build the sites. GM’s Ultimate Charge 360 initiative had already partnered with seven of these networks. One of them, EVgo, was familiar with the c-store industry’s interest in EV charging, having previously worked with Sheetz, Wawa and Terrible Herbst.

After GM made an introduction between Pilot and EVgo, it was off to the races.

“We were used to the c-store model,” said Jonathan Levy, chief commercial officer for EVgo. “But this was the first time of something of this scale with a c-store brand.”

The companies discussed incorporating Pilot’s general business goals into building out its EV stations. They emphasized customer experience and reliability.

Beyond Pilot’s ideal interstate locations, the fact that the chain operates 24/7 and always has staff monitoring the facilities also drew GM to the partnership, Wolff said.

Tully said the partnership with GM and EVgo is helping Pilot prepare for the future by establishing itself as a place EV drivers can rely on for charging.

“GM helped us get our charging network in place to give drivers a more complete experience,” he said. “They were the yang to our yin.”

Creating the right experience

Pilot’s charging stations will feature canopies to help protect customers from the weather while charging, as well as a pull-through design, which allows easier charging for electric pickup trucks and SUVs pulling trailers. They’ll also be capable of offering up to 350-kilowatts, which is the fastest type of charge.

Still, the time it takes to charge a vehicle will depend on the make of the car, Tully said.

“We’re expecting people to [be charging] from 15 to 45 minutes,” he said.

Tully also emphasized that the charging stations will be in a separate area of the forecourt than its gas pumps, which will continue to operate as normal. Keeping its fuel operations as-is aligns with Pilot’s recent activity; in November 2021, the company acquired Southern Counties Oil, a gasoline provider that operated about 50 proprietary cardlock locations.

“[The charging stations] will have no impact on the fuel,” he said.

Pilot will use a “plug and charge” model at its charging stations, which lets customers drive up and plug their vehicle’s cable into the charge point. Drivers only need to set up their payment the first time they charge, and on subsequent visits, their information will already be in the system. Wolff said he’s especially excited about this, since consumers have often had payment issues with EV charging in the past.

“There’s no need to sugar coat it — there have been challenges with charger reliability to date,” he said.

But planning to build 2,000 EV charging stations nationwide comes with its own challenges. A big one is building the charging infrastructure at each site, Wolff said. This not only requires getting the proper permits to build, but also considering the site-specific details, such as the design and layout of the space and how many chargers it can accommodate. Wolff said they chose Pilot locations that were already in the process of upgrading their facilities with things like new restrooms and quick-service restaurants on site.

“How do we pick the best sites in the best spots for our customers?” Wolff said. “It's not just about traffic — it’s about creating the right experience.”

Incorporating EV charging isn’t the only major change Pilot is undergoing these days. As part of its $1 billion “New Horizons” strategy, which includes its EV initiative, the company is updating hundreds of stores with new foodservice stations, more energy efficient lighting, self checkout stations and more. The company plans to update around 400 stations as part of the initiative, which was announced in March, and has so far completed around a quarter of those updates, according to Allison Cornish, Pilot’s vice president of store modernization.

It’s all about convenience

It’s clear that larger c-store chains are going all-in on EV charging. But how big of an impact will the trend have across the industry?

“You have to break it down regionally,” said Tully. “It’ll somewhat depend on how urban an area you're in. If you're in California, [EV rollout] will probably happen faster than in Nebraska. But we think this is a real trend that’s coming.”

At the recent NACS Show in Las Vegas, Parkland CEO Doug Haugh said that two distinct consumer opportunities are emerging for EV charging providers. One is the millions of people who don’t keep their cars in garages, and thus may not have at-home access to charging. The other is the many travelers driving along highways and interstates who need charging points to complete their journeys — a consumer set that Pilot’s travel centers are poised to meet.

“There’s a clear opportunity and a clear need to provide the services to these travelers,” said Haugh.

Others are more skeptical about EVs making a big difference throughout the c-store industry. Frank Beard, a retail analyst who works in marketing for autonomous checkout company Standard AI, said EV charging seems to be a bonus rather than a core value proposition for c-stores.

“It can be a fine amenity for some brands in some circumstances — like truck stops on long routes — but it's going to take more than chargers to future-proof neighborhood c-stores,” he said. “C-stores sell 80% of America's gasoline. It's hard to see a pathway to charging 80% of America's vehicles."

While Tully also acknowledged that consumers can charge EVs at home or elsewhere, he said a larger question looms for him: How can c-stores increasingly attract EV drivers?

“It’s all about convenience, but given the ability for home owners to charge, it’ll be interesting how that develops,” he said. “That could mean selling more things inside the store that apply to the EV charging process.”

Despite the potential business challenges, c-stores are an ideal fit for EV charging stations, Levy said, since when drivers are charging, they’ll go into the c-store — just like they often do when filling up on gas. Top c-store brands seem to feel the same way, as seen in the flurry of recent EV-charging initiatives around the industry.

And this trend appears to only be getting started. A report from KPMG found that automotive executives, on average, expect about half of new car sales in the U.S. to be EVs by 2030.

“It’s no longer a question of if or when with EVs,” Levy said. “The question is how fast.”

Jeff Wells contributed reporting to this story.