Dive Brief:

- New York City is exploring adding payment chips to its municipal ID cards, allowing cardholders to store and spend money on the card.

- If executed, the system would add a new financial option for the estimated 360,000 households that are unbanked or underbanked, meaning not served by a bank or insufficiently served, respectively. The city pitched it as a "convenient, accessible, and equitable savings and payment tool for all New Yorkers."

- The mayor’s office issued a request for expressions of interest, with a June 29 deadline for submissions. A winner will be announced by December 2018.

Dive Insight:

New York’s municipal ID card program is the largest in the country, offering a way for vulnerable residents — like undocumented immigrants or the homeless — to get a photo ID that works for government services. While many cities have developed the cards, New York has gotten kudos for applying benefits like museums or gym discounts to the cards. Chicago cited New York’s program as a model when it rolled out its own municipal ID program this year.

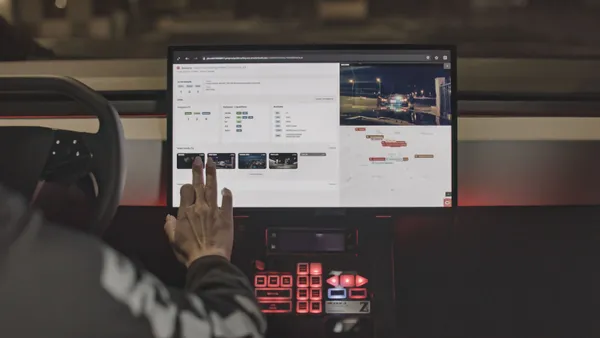

Many other cities have incorporated finances to the IDs, having them act as debit cards. Oakland, CA was the first to adopt them in 2013, since many of the same people that would need to rely on a municipal ID are also likely to be unbanked. Adding banking to the cards would help them become even more of an all-in-one system by making it eligible for transit fares (this also comes as the transit authority is eyeing upgrades to its fare payments).

Such a plan can also help ensure that citizens are not left behind as cities move to increasingly cash-less economies. The Guardian points out that the unbanked have fewer options in a smart card-dominated economy, quoting Mastercard CEO Ajay Banga of warning of "creating islands, where the unbanked transact [only] with each other."