A number of the country’s largest construction projects are set to hit major development milestones in 2023.

Priced from the hundreds of millions to the tens of billions, these developments-in-progress are notable for their size, impact and importance to their respective sectors. They include an NFL stadium, a major airport expansion and a massive manufacturing plant.

Below are just a few of the projects Construction Dive is planning to keep an eye on in the year ahead:

Buffalo Bills’ stadium

Orchard Park, New York

$1.4 billion

This spring, a Gilbane-Turner JV will begin construction on the $1.4 billion stadium for the NFL’s Buffalo Bills in Orchard Park, New York, with plans to finish the project before the 2026 season. Kansas City, Missouri-based Populous will serve as architect.

New York Gov. Kathy Hochul approved the stadium project last March. Several contributors will fund the project, which will be among the most expensive ever built. The Bills and the NFL will provide $550 million, Erie County $250 and New York state $600 million. Per an agreement with the state, the stadium must include at least 60,000 seats.

Renderings released in October show the stadium will be open-air and feature a stacked seating design — which the franchise said will make crowd noise more deafening. Additionally, extensive radiant heating will keep fans comfortable during the harsh upstate New York winter.

The JV will build the yet-to-be-named stadium on Abbott Road, across from Highmark Stadium, which will continue to serve as the Bills’ home field for the time being.

JFK Airport expansion projects

New York City

$14.2 billion

The terminal projects at John F. Kennedy International Airport are part of its transformation to accommodate dramatic expected growth in coming years. The $400 million Terminal 8 modernization began in 2019 and wrapped in 2022, but other elements are still underway. In the coming year, construction is expected to advance on Terminals 1, 4 and 6.

The $9.5 billion Terminal 1 project broke ground in September 2022 and will be completed in three phases. The design-build team is composed of AECOM Tishman and Gensler. Work entails building 23 new gates, retail, dining and an indoor green space on the old sites of Terminals 1, 2 and 3. It’s expected to open to passengers in 2026 and be fully complete by 2030.

Terminal 4, with a price tag of $1.5 billion, was approved in spring 2022 and is now under construction. Delta Airlines is managing construction with support from firms including STV, Turner Construction, Group PMX, McKissack and NYCO. Work will include new gate areas, seating and space to relax.

Construction on the $4.2 billion Terminal 6 is set to start in early 2023. It will be built through a P3 between the Port Authority of New York and New Jersey and JFK Millennium Partners, a consortium that includes Vantage Airport Group, American Triple I, real estate operating company RXR and JetBlue Airways. The new terminal will have 10 gates, shopping and dining, according to the New York Governor’s Office.

Southeast Connector

Dallas-Fort Worth area

$1.6 billion

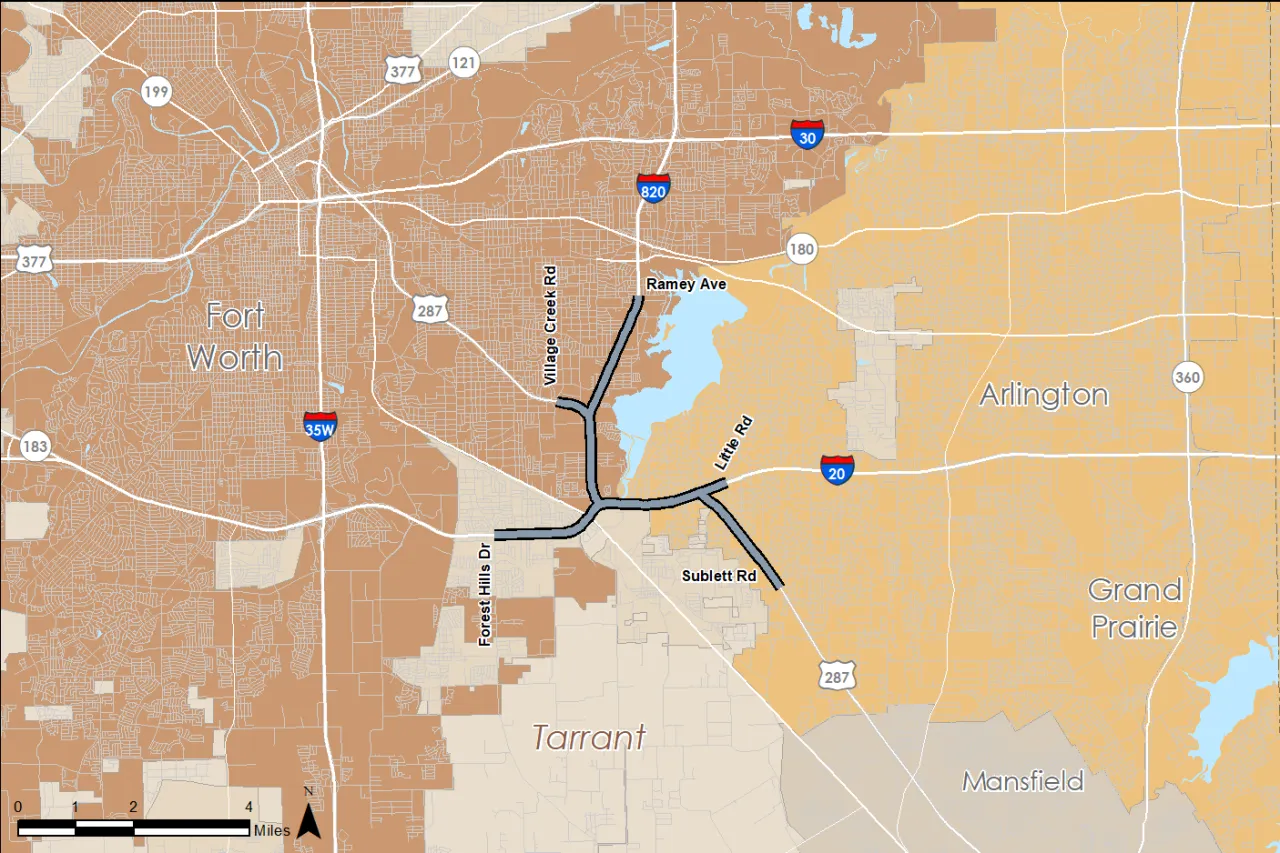

The Southeast Connector Project is a 16-mile effort to widen I-20 and I-820 and rebuild interchanges between the two freeways and Highway 287. South-Point Constructors, a joint venture with Kiewit Infrastructure South and Austin Bridge & Road, landed the design, build and maintenance contract.

The project’s goal is to relieve traffic delays and facilitate trade, increase safety and improve efficiency around Fort Worth, Texas. It will tie in the east and southeast part of Tarrant County — the state’s third most populated county — to Fort Worth.

The Southeast Connector represents the Texas DOT Fort Worth District’s largest investment in transportation infrastructure to date, the agency said. It launched in December 2022 and is projected to be finished by 2027.

BMW supplier EV plant

Florence, South Carolina

$810 million

Announced last month, an $810 million EV battery supply plant in Florence County, South Carolina, will boost EV battery production in the Palmetto State.

Japanese EV battery firm Envision AESC will supply battery cells to be used in the next-generation electric vehicle models produced at the BMW Group’s Plant in Spartanburg (shown above).

The investment will create 1,170 new jobs and support the company’s multi-year partnership with the BMW Group, according to the release, and is part of a wave of EV battery production facilities throughout the U.S.

Located in an 870-acre Technology and Commerce Park in Florence, the plant will encompass approximately 1.5 million square feet and builds on AESC’s existing United States network that includes a battery manufacturing plant in Tennessee and a plant under construction in Kentucky.

BMW isn’t the only automaker ramping up electric vehicle production this year. Honda revealed plans for an “EV hub” in Ohio in December, selecting a battery production site near facilities it will retool for EVs. Hyundai announced last year that it has broken ground on a campus where both batteries and a diverse line of EVs will be manufactured.

Amazon data center campus

Northern Virginia

$35 billion

Amazon plans to invest $35 billion by 2040 on multiple data center campuses across Virginia, according to a statement earlier this month from the office of Gov. Glenn Youngkin.

The plan still depends on the approval of Virginia's new Mega Data Center Incentive Program by the Virginia General Assembly. If green lit, Youngkin’s office has said Amazon would be eligible for the program.

Though specific localities have not yet been disclosed, Northern Virginia has long been touted as “Data Center Alley” by industry pros. The area remains the largest data center market in the country, according to a 2022 CBRE analysis on data center trends.

That’s because the state continues to attract data center projects due to its relatively cheap land and power, coupled with record tax initiatives, said Youngkin.

Other data center projects currently underway in the area include a 24-megawatt data center campus in Ashburn, Virginia, for NTT, a Japanese IT infrastructure and services company. Clark Construction Group, the Bethesda, Maryland-based construction firm leading the project, expects the 188,000-square-foot facility to be ready in the first quarter of 2024.

Meanwhile, near Richmond, Virginia, QTS, an Overland Park, Kansas-based REIT, announced last year plans for a 1.5 million-square-foot expansion to its data center campus in White Oak Technology Park in Henrico County, Virginia. The expansion brings additional data center space to its already existing 1.4 million-square-foot data center next door.

Fontainebleau Las Vegas

Las Vegas

$3.7 billion

Aventura, Florida-based Fontainebleau Development and Koch Real Estate Investments, the real estate investment arm of Wichita, Kansas-based Koch Industries, secured a $2.2 billion construction loan to complete the Fontainebleau Las Vegas luxury resort and casino, according to a press release last month.

The loan keeps the construction of the 67-story hotel, gaming, meeting and entertainment project on track to be completed in the fourth quarter of 2023, according to the release. The site stretches across 25 acres and 9 million square feet on the north end of the Las Vegas Strip, directly adjacent to the Las Vegas Convention Center. The project will feature 3,700 hotel rooms, 550,000 square feet of convention and meeting space, as well as gaming, dining, retail and health and wellness experiences.

Construction on the site initially broke ground in 2007. Progress was stymied during the Great Recession as the site changed developers a number of times, with activity again stopping in 2020 amid the COVID-19 crisis.

Another long-awaited Las Vegas entertainment project set to debut in the second half of 2023 includes the $2.18 billion MSG Sphere at The Venetian. The venue will have a capacity of approximately 17,500 seats, expandable to 20,000 with standing room, and will include the largest spherical structure in the world.

Related Santa Clara

Santa Clara, California

$8 billion

After a series of development delays related to the COVID-19 pandemic, Related Santa Clara, a collaboration between New York City-based developer The Related Cos. and the city of Santa Clara, California, is set to begin vertical construction this year.

The first phase, known as the “Tasman Block,” will consist of a 430,000-square-foot office complex, 50,000 square feet of retail, a 480-room business hotel, 200 apartments and a 1,900-space underground parking garage, according to a public presentation on the project. Foster+Partners is the lead design architect for the project’s first phases, while Gensler will serve as the executive architect.

Once complete, Related Santa Clara will comprise 9.2 million square feet of developed space across 240 acres adjacent to Levi’s Stadium, home to the NFL’s San Francisco 49ers and the Santa Clara Convention Center.

The development breakdown includes:

- 1,680 residential units (170 designated as affordable).

- 5.7 million square feet of office space.

- 700 hotel rooms.

- A 35-acre park.

- 25 acres of open space.

- 800,000 square feet of retail, restaurant, and entertainment space, including a global food market.

An adjacent development, Tasman East, will add 4,500 residential units across 40 acres — 1,600 developed by Related and 2,900 by other developers. Related recently announced $690 million in construction financing for Tasman East.