This week’s general election could be among the most significant for the waste and recycling industry in years. The outcome will impact stakeholders on multiple fronts, with policy and regulatory implications on every level of government in the United States.

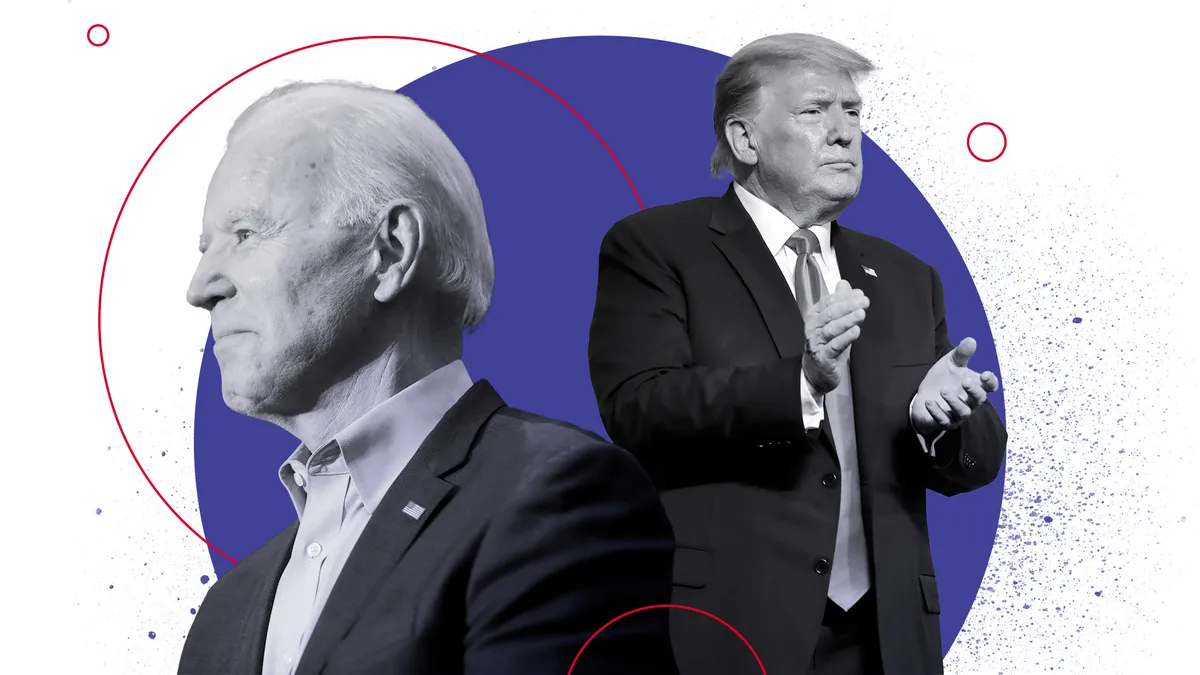

Waste experts have repeatedly pointed to the Nov. 3 election in recent months as a key moment. Much of that focus is on the presidential election — President Donald Trump’s re-election would signal a continuation of the status quo, while former Vice President Joe Biden would be expected to usher in a dramatic shift in policy. A Biden administration would likely approach issues like climate change and chemical contamination very differently than Trump, and industry players believe a power shift would also impact tax rates.

Another notable space to watch is Congress, with implications for multiple federal recycling bills and contentious issues like contamination by per- and polyfluoroalkyl substances (PFAS). The industry is also keeping an eye on state-level elections, which come amid a growing focus on issues like environmental justice and recycling policy.

Here are some of the areas at stake, according to industry experts, as voting nears its conclusion:

Taxes and M&A

Taxes will be a major area subject to change if Biden becomes president, according to experts. At this year’s virtual WasteExpo, Stifel Managing Director Michael E. Hoffman said the corporate tax and capital gains tax rates would likely go up if Trump leaves office, in keeping with typical trends under Democratic leadership. The Trump administration significantly reduced the corporate tax rate; raising it would impact the industry’s bigger C-corporations. A change in the capital gains tax, by contrast, would impact smaller companies, potentially leading to "about a 10-15% reduction in total free cash flow generated,” per Hoffman.

M&A would similarly be impacted by a change in the White House, and figures like Waste Connections Executive Chairman Ron Mittelstaedt have predicted the space would see a major decline under Biden. During the Trump presidency, M&A has seen several years of growth and proceeded at a near-record pace for many companies. Changes to tax rates and a shift in focus could affect that activity, while also potentially leading to a near-term rush of deals if a reversal is seen on the horizon under new federal control.

Recycling and EPR legislation

The fate of multiple federal recycling bills may hinge on the outcome of the election. The education-focused RECYCLE Act and infrastructure-centric RECOVER Act have both received some bipartisan support but stalled amid the coronavirus pandemic. Those bills could see a revival depending on the priorities established by the next Congress, as could more recent bills like the Plastic Waste Reduction and Recycling Act introduced this summer.

One bill that has been controversial with the waste industry is the Break Free From Plastic Pollution Act. That legislation would establish extended producer responsibility for packaging on a national level, along with a federal container deposit system and bans on multiple types of plastic. Democratic members of the House Select Committee on the Climate Crisis endorsed that bill this summer in a sweeping climate action plan, along with legislation like the Zero Waste Act. That document also backs recycled content minimums, requirements for organics and recycling in regards to combating climate change, and areas like electrification for fleets.

The U.S. EPA under Trump has sought to bolster recycling, with the agency repeatedly stating a preference for voluntary goals over regulations. The administration also backed the original “Save Our Seas” Act, as well as its successor, “Save Our Seas 2.0,” which has passed both chambers of Congress in different forms and may still have prospects.

Climate change

The Trump administration has taken a largely deregulatory approach to environmental and climate policy, including on issues like landfill emissions, which has sparked lawsuits against the EPA. That is among major areas where the industry could see a shift if Biden is elected, as cracking down on methane emissions would be a priority.

Climate policy more broadly would also change dramatically under a Biden administration. The former vice president has a $2 trillion climate plan that aims to see the United States achieve net-zero emissions by mid-century and eliminate power-sector carbon emissions by 2035. Those goals could push industries to pursue a shift to electric vehicles faster, a change Republic Services has been bullish on and other players are eyeing. Biden has also signaled his openness to carbon pricing; earlier this year landfill operators said cap-and-trade policies could cost them $138 million in the first year of such a system alone. By contrast, the Trump administration would likely continue to reverse or revoke certain regulations while seeking to support sectors including oil and gas.

PFAS

Issues around PFAS disposal are among the biggest facing the waste industry, with multiple sectors already experiencing financial impacts including in the biosolids and landfill spaces. Under the Trump administration, the EPA has repeatedly touted its work on PFAS, including its PFAS Action Plan. But multiple sources say the agency is stalling on setting a maximum contaminant level (MCL) for drinking water. The president has also threatened to veto legislation that would regulate some PFAS.

By contrast, Democrats and some congressional Republicans have been pushing for PFAS legislation targeting a number of areas. Those include drinking water standards, limitations on the incineration of PFAS-laden firefighting foam, and items like food packaging which have brought the chemicals into compost. A complicated regulatory framework around PFAS is taking shape at the state level, especially in regions like the Northeast, as governments respond to public outcry. Stifel’s Hoffman is among the industry experts who believe a Democratic White House might seek swift action on PFAS.

Shifts at the EPA

The industry’s relationship with the EPA could change significantly if Biden wins. Under Administrator Andrew Wheeler, for example, the EPA has sought to delay the 2016 Emissions Guidelines (EG) landfill rule and New Source Performance Standards (NSPS) rule. That delay has been opposed by multiple Democrat-led states, and a coalition of nine attorneys general sued in opposition. If Biden becomes president, it is likely the EPA would change its position on the rule.

Recycling could be another Biden focus, but it would also remain a priority under a second term for the Trump administration. The EPA is currently working on setting national recycling goals and bolstering the sector. Food waste reduction has been another Trump administration focus, with the U.S. Department of Agriculture and U.S. Food and Drug Administration partnering with the EPA on a major food waste initiative in 2018. The Trump administration has continued an Obama-era food waste goal of achieving 50% reduction by 2030. And ongoing debate over the renewable fuel standard — a long-running source of contention for biogas producers — would likely continue into a second term for Trump.